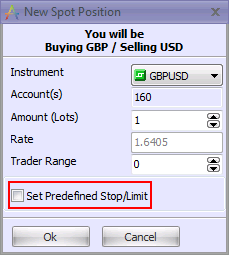

When creating a market order, you can predefine a stop/limit order. When the market order becomes a position, it will have the stop/limit order on it.

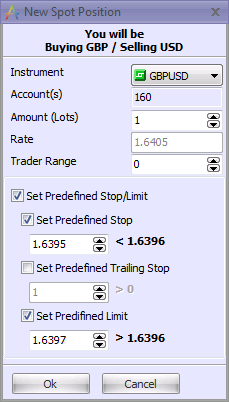

When you check the "Set Predefined Stop/Limit" check box, the dialog box expands, allowing you to set a predefined stop and/or limit.

To set a predefined stop, trailing stop, or limit, click on the check box next to the desired order type. When you select the checkbox, the order rate becomes editable. The rate constraints to the right of the rate fields are based on the type of order and the condition distance setting.

Note: It is not possible to set both a predefined stop and a predefined trailing stop. Only one or the other may be checked.

Select the relevant check box and adjust the order rate. If you change your mind and decide not to place that order, simply uncheck the check box. If you uncheck the “Set Predefined Stop/Limit” check box, the dialog box will collapse to its previous size and any predefined stops/limits you selected will be discarded.

Once you have edited the predefined stop/limit orders to your satisfaction, click OK to place the order.

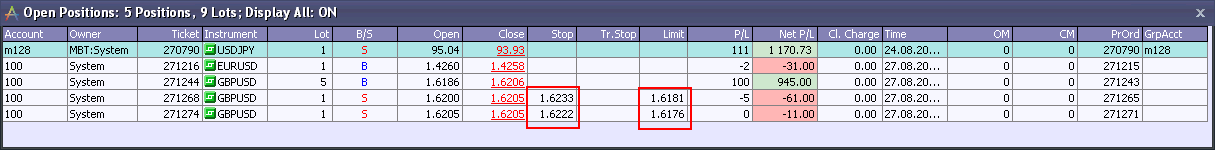

The market order will appear as an “I” order in the Orders window, with the predefined stop and/or limit already entered.

Upon order confirmation, the position will open with the stop and/or limit in place.

Note: The application will remember whether the “Set Predefined Stop/Limit” check box was checked or not at the moment the “New Position” dialog box was closed. The next time the dialog box is open, it will be expanded or contracted, depending on its most recent state.

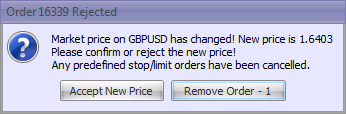

Rejected Market Orders

If the you create a market order with a predefined stop/limit, and the order is rejected because of a price change, the predefined stops/limits will be automatically canceled. This information will be reflected in the “Rejected order” message.

If you choose to open the position anyway (Accept New Price), you will have to set the stop/limit manually in the Open Positions window.

Note: If the dealer chooses to confirm your order at a different rate from the order rate, predefined stops/limits will not be affected.

Predefined Stop/Limit constraints explained

The constraints on the possible rates of predefined stops and limits depend on the projected closing price when the position opens and on the condition distance setting. The projected closing price is calculated by taking the entry order price and adding/subtracting the current spread. Condition distance is then added to/subtracted from this projected closing price to determine the maximum/minimum possible rate for stops/limits.

Example: The current Bid rate is 28 and the current Ask rate is 33. The spread is 5. Condition distance = 1. You place an entry stop order to buy at Ask = 40. The projected closing price of the position (when it opens) is 40 – 5 (the spread) = Bid 35. Factoring in condition distance, we find that the maximum predefined stop rate is Bid = 34 (35 – 1). The minimum predefined limit rate is Bid = 36 (35 + 1).

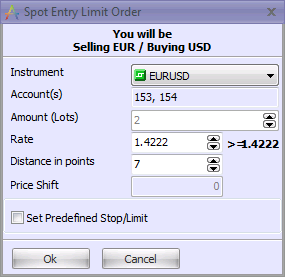

Multiple Accounts

It is possible to place market orders with predefined stops/limits from multiple accounts using the multiselect feature. In the event that the selected accounts have different condition distance settings, the largest of the settings will be used for all accounts.

Example:

Bid=1.4215 Ask=1.4220

Acct. 153 condition distance = 5: Acct. 154 condition distance = 7

For both accounts, the larger condition distance of 6 will be used to calculate the constraints on the predefined stop/limit:

1.4215 – 7 = 1.4208; Stop at 1.4208 and lower.

1.4215 + 7 = 1.4222; Limit at 1.4222 and higher.