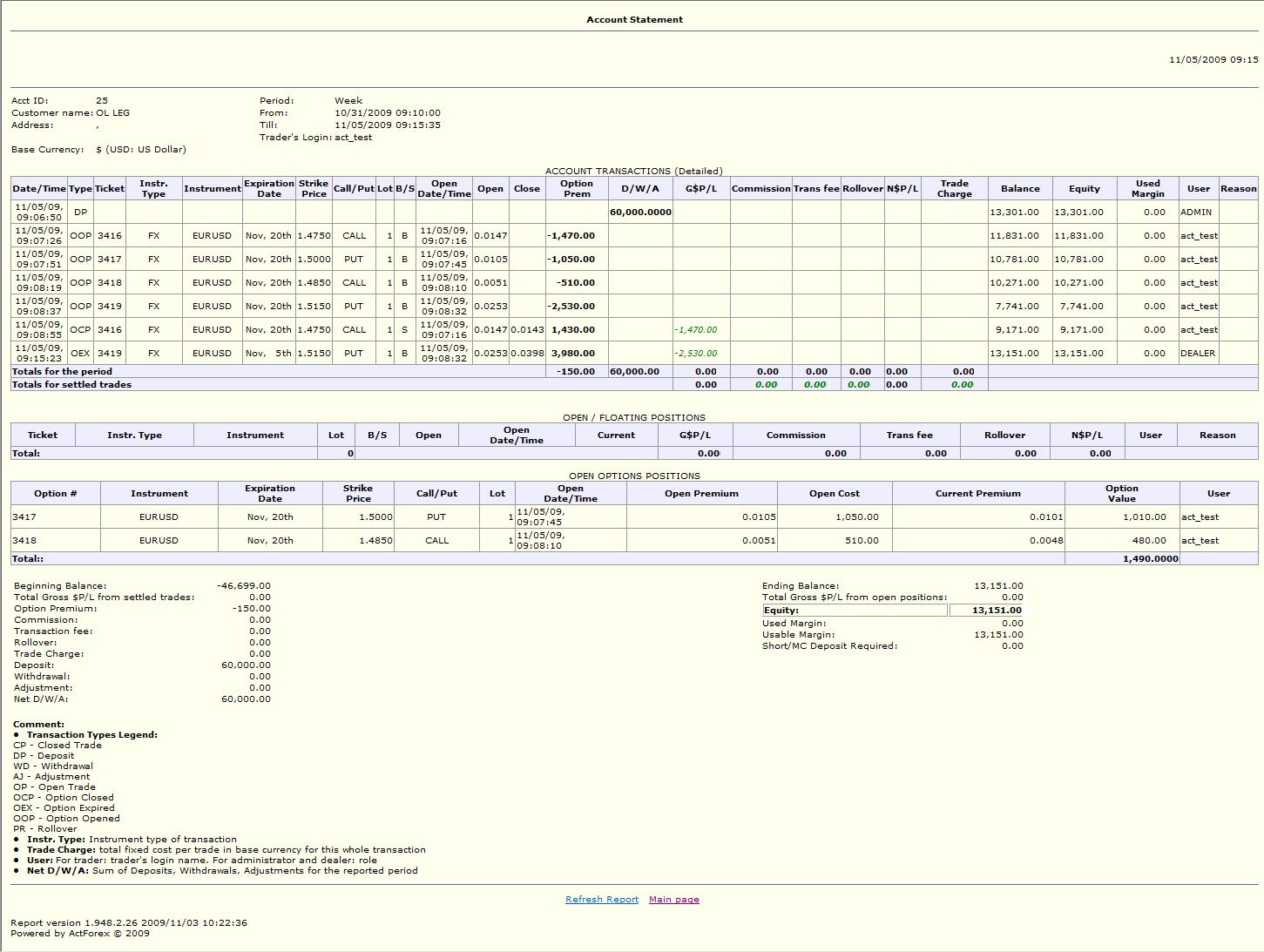

Opening and closing of Options positions and expirations of options are reflected in the Account Transactions table of the Account Statement report. Open Options positions are displayed in the Open Options Positions table of the Account Statement report.

Type

Transaction type

OOP - option opened

OCP - option closed

OEX - option expired

Ticket

The option number.

Option Prem

The amount per unit of currency that an option buyer pays to the seller.

The option premium is primarily affected by the difference between the stock price and the strike price, the time remaining for the option to be exercised, and the volatility of the underlying stock.

Option#

The option number

Instrument

Instrument name. This is the name that can be set and customized by the administrator in the Instruments section of the ActAdmin. For example, for GBPUSD, the instrument name may read "Cable".

Expiration Date

Option expiration date.

Strike Price

The specified price on an option contract at which a call option buyer can buy the underlier or a put option buyer can sell the underlier.

The buyer's profit from exercising the option is the amount by which the strike price exceeds the spot price (in the case of a put), or the amount by which the spot price exceeds the strike price (in the case of a call).

Call/Put

A Call is an options contract that gives the buyer the right to buy the underlying commodity at the strike price on the expiration date.

Put is an options contract that gives the buyer the right to sell the underlying commodity at the strike price on the expiration date.

Lot

Number of lots in the option. If the system is set in amounts (rule Show Trade/Order Size as), the column is titled Amount and displays the amount in the option.

Open Date/Time

The date and time of opening of the option.

Open Premium

Premium at opening of the option. Premium is calculated by the system using the volatility data specified in ActAdmin->Options-> Market volatility or Static Volatility. If negotiation on opening of an option is “Full”, dealer may manually change the open premium of the option before confirming the transaction.

Premium is used to calculate open cost of the option.

Open Cost

Total cost of opening of the option position. The open cost is subtracted from the account balance at the time of the transaction.

Open cost is calculated by the system via the following formula:

Cost = Premium*Contract size*Number of lots

Note: If negotiation on opening of an option is “Full”, dealer may manually change the open premium of the option before confirming the transaction, thus altering the calculated open cost of the option.

If the resulting open cost is less than the Minimum Cost, then the Minimum Cost will be applied instead of the above formula. The Minimum Cost is equal to the Number of Lots*Minimum Cost per Lot specified in ActAdmin for this instrument. In this case, the Premium is not used to calculate the open cost of the option.

Current Premium

Premium at the end of report period. Premium is calculated by the system using the volatility data specified in ActAdmin->Options-> Market volatility or Static Volatility. If negotiation on closing of an option is “Full”, dealer may manually change the close (current) premium of the option before confirming the transaction.

Current Premium is used to calculate the option value.

Option Value

The value the trader would receive for closing of the option position at the end of report period. Option value would be added to the account balance at the time of the transaction.

Option value is calculated by the following formula:

Option Value = Current Premium*Contract size*Number of lots.

Note: If negotiation on closing of an option is “Full”, dealer may manually change the close (current) premium of the option before confirming the transaction, thus changing the options value.

The Minimum Cost per lot setting has no effect on determining the option value.

User

The login of the trader or dealer that confirmed the buy option transaction.

Trader’s login appears in this column if the negotiation on buying an option was AUTO at the time of the transaction and the transaction did not require dealer’s confirmation.

Dealer’s login appears in this column if the negotiation on buying an option was FULL at the time of the transaction and the dealer confirmed the order without changing the option premium (cost).

Trader’s login appears in this column if the negotiation on buying of an option was FULL at the time of the transaction, the option was re-priced by dealer (set new open premium and open cost), trader accepted the new cost.