The purpose of the Account Statement report is to review all transactions, open positions and an account summary for the selected time period. By default the report period is set to Day, All Accounts radio button is preselected and Markup check box is checked. Traders have access to markups by default (if Markups are enabled on the system). Customers' access to markups is regulated by the rule Markups: Show in Customer Statement.

Account Statement report can be accessed in a following ways:

| • | for traders, through the ActTrader (Windows Tab -> Reports) and through the ICTS Reporting (using personal logon and password) |

| • | for customers, only through the ICTS Reporting (using personal logon and password). |

When running the report both traders and customers are able to see all the accounts assigned (for trader) and owned (for customer) to/by them.

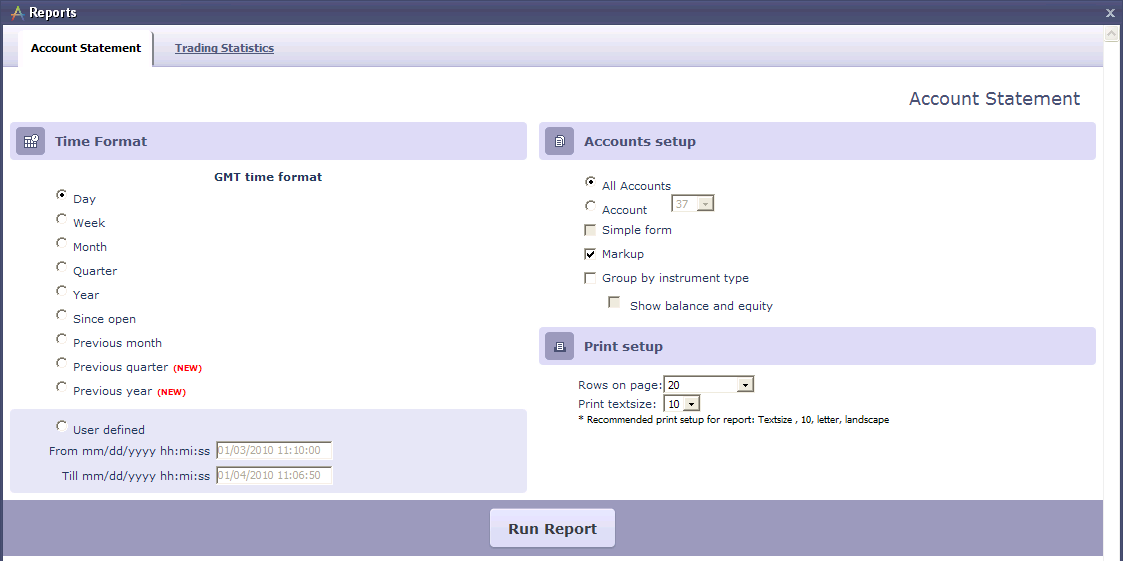

Report Interface

Configuring the Report

The following are the options for the report period:

Day

(End of previous trading day till the present moment)

Week

(End of previous trading week till the present moment)

Month

(End of previous trading month till the present moment)

Quarter

(End of previous quarter till the present moment)

Year

(End of previous calendar year till the present moment)

Since open

(From the moment of the first account creation in the system till the present moment)

Previous month

(From: end of the month preceding the previous calendar month Till: the end of previous calendar month)

Previous quarter

(From: end of the quarter preceding the previous quarter Till: the end of previous quarter)

Previous year

(From: end of the year preceding the previous calendar year Till: the end of previous calendar year)

The last two additional timeframes allow the user to gain a better understanding of the long-term trading statistics.

User defined

This section allows you to define the start and end points of the report period. This is the most flexible option, allowing you to define the report period with great precision (to the second). The From and Till fields must be filled out in mm/dd/yyyy hh:mi:ss format.

Note: The report is generated in either GMT or EST time format, depending on your system configuration.

Account(s)

In this section, you can either select "All Accounts" to run the report for all your account(s), or select an individual account if you have more than one.

Checkboxes

| • | Simple form: The Account Statement report can be displayed in a simple or detailed form (uncheck the “simple form” checkbox to see the detailed report). In the simple form, the report’s Account Transactions section will only show position closings. Please note that if the simple form is selected, the Markup box becomes grayed out. Likewise, if the Markup box is checked, the Simple form box becomes grayed out. |

| • | Markup: Check this box to display markups in the body of the report. |

| • | Group by Instrument type: When this check box is checked, the report will be split into multiple tables with each table only displaying transactions/positions with a certain instrument type (in alphabetical order: transactions table with CFD first, then ETFs, FUT, FX, then open/floating positions tables in the same order: CFD, ETF, FUT, FX). Account transactions and open/floating positions of each instrument type will be shown in chronological order. |

Note: By default, when the report is grouped by instrument type, the D/W/A, Balance and Equity columns are not displayed. Information about deposits, withdrawals and adjustments can be viewed in the Report summary. To display balance and equity, you must check the “Show balance and equity” check box though it is not recommended as the balance and equity in this case will not necessarily be in chronological order, since the report is now grouped by instrument type.

Note: The Group by instrument type checkbox is available in the report interface only if there are at least two instrument types in the system and at least two instruments of each instrument type are created.

| • | Show balance and equity: This check box is active only when ''Group by Instrument type'' is checked. Check this box to display balance and equity in the body of the report. |

Pagination

This report can be set to display a certain number of rows per page: 20,40,60,80, “by Rule”, or “No Pagination”. "By Rule" refers to a pagination value set by the system administrator.

Report Body

The Account Statement report consists of four main sections:

| 1. | Basic report/account information in the header |

| 2. | “Account Transactions” |

| 3. | “Open/Floating Positions” |

| 4. | Report summary/footer information |

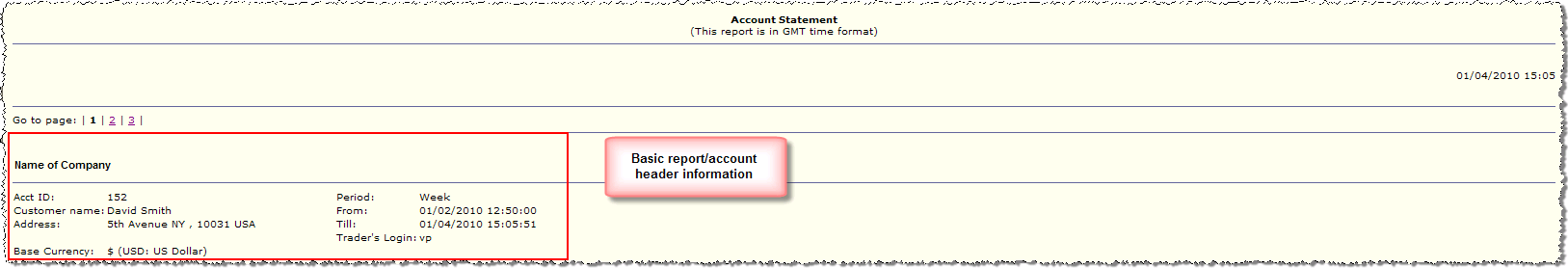

Basic report/account header information

This section displays the following information:

| • | Account ID - account, for which the report has been generated, |

| • | Customer name - the name of account's owner, |

| • | Address - customer's address, |

| • | Base Currency - the name of the system base currency, |

| • | Period - report period selected in the interface, |

| • | Report "From" and "Till" dates - particularly the day and time, from which the report starts ('From'), and the day and time, when it ends ('Till'). |

| • | Trader Login - trader's login |

| • | Time/date of report generation - at the right top is shown the day and time of the report generation. It coincides with the ‘Till’ time except when the report period is previous month, previous quarter, previous year or defined by user. |

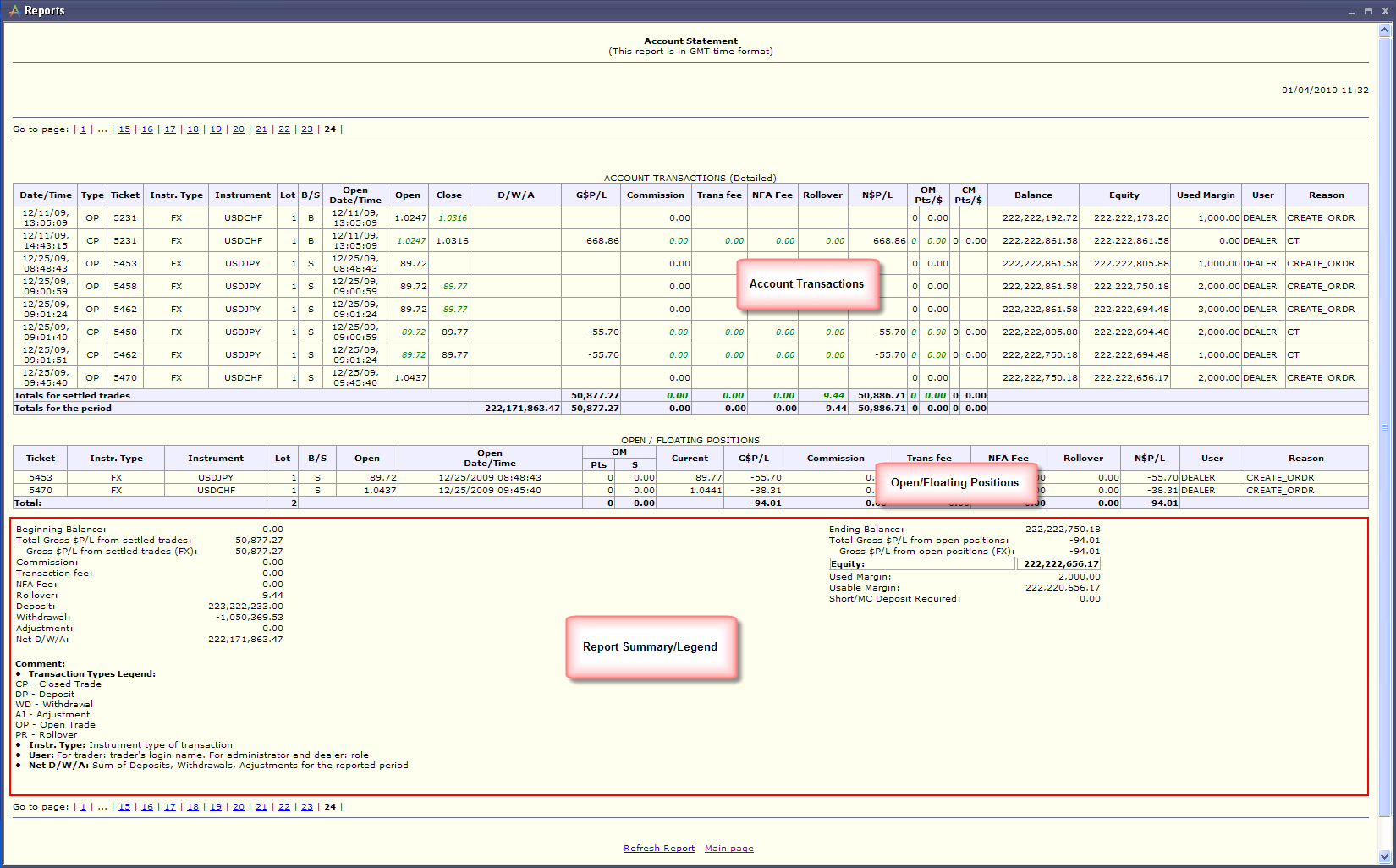

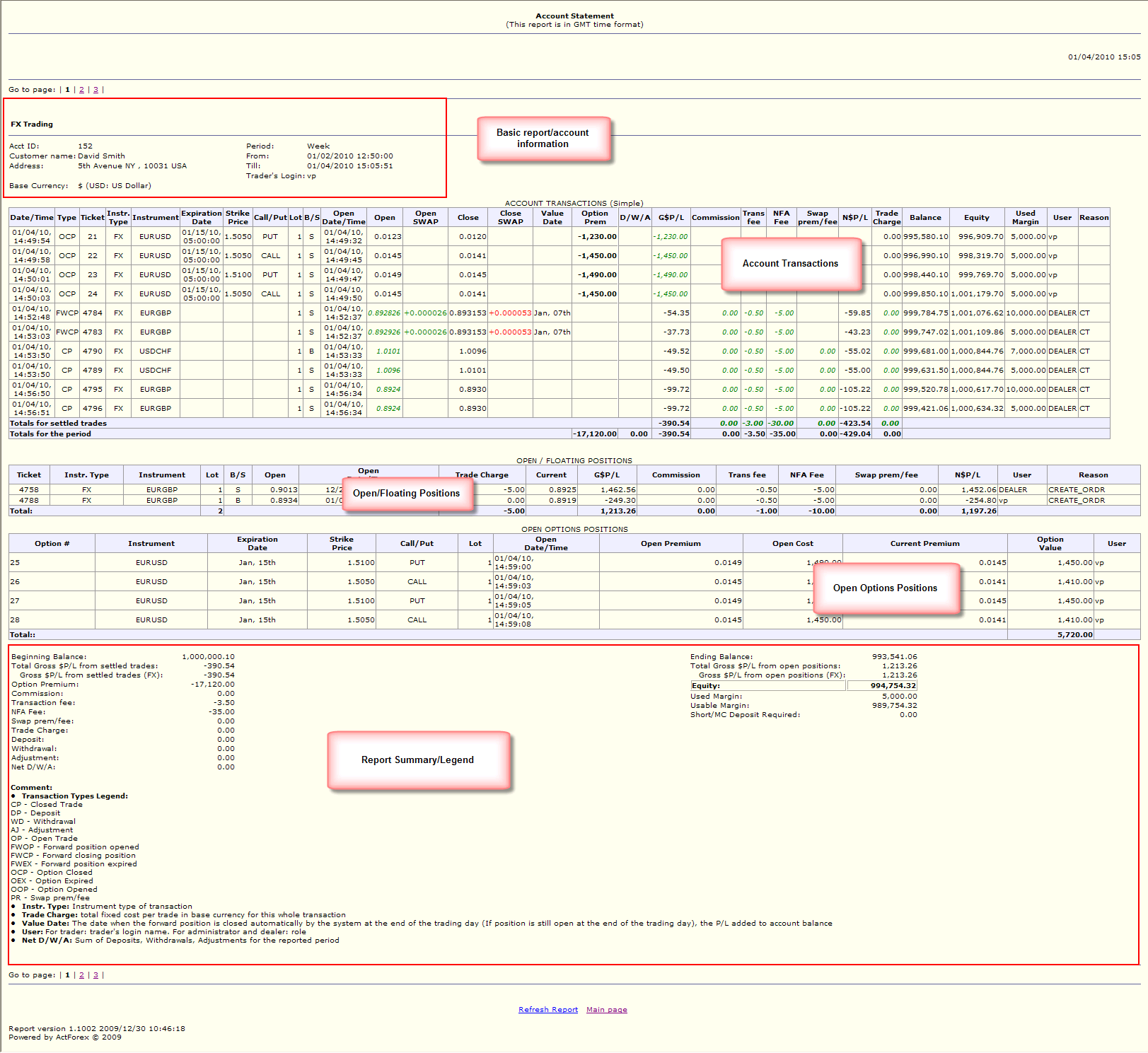

Account Transactions

This section chronologically lists all account transactions for the selected time period.

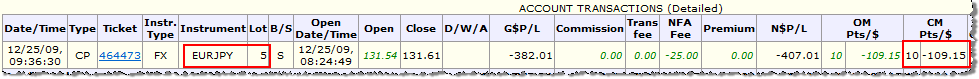

If you have only FX type instruments in your system, the report will look like this:

If you have all the instrument types in the system, the report will look like this:

Column descriptions

PLEASE NOTE: Forwards, Options and Futures may not be available in the system. In this case the corresponding columns will not appear in the report body.

Date/time

Date and time of the transaction

Type

Transaction type

AJ |

Adjustment |

DP |

Deposit |

WD |

Withdrawal |

OP |

Open Trade |

CP |

Closed Trade |

PR |

Overnight Rollover fee |

FWOP |

Forward position opened |

FWCP |

Forward position closed |

FWEX |

Forward position expired |

FE |

Future Expiration |

OCP |

Option Cosed |

OEX |

Option Expired |

OOP |

Option Opened |

Ticket

Ticket number (option number for option position).A ticket number is the number assigned by the system to a position.

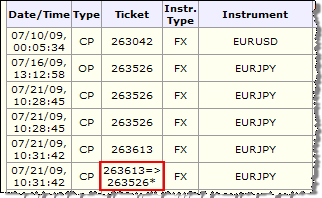

When a partial closing of a position took place, the Ticket column will display 2 ticket numbers connected by an arrow. For example, XXX1=>XXX2. This means that ticket XXX2 was partially closed by an order XXX1.

Instrument Type

Type of instrument (FX, CFD, ETF, FUT)

Note: If the report is grouped by instrument type (Group by Instrument type checkbox is checked in the report interface), then this column will not appear in the report.

Instrument

Instrument name

Expiration Date

Expiration date for futures or/and options contracts (the column is available only if there were any futures or options transactions within the report period).

Strike Price

The specified price on an option contract at which a call option buyer can buy the underlier or a put option buyer can sell the underlier.

The buyer's profit from exercising the option is the amount by which the strike price exceeds the spot price (in the case of a put), or the amount by which the spot price exceeds the strike price (in the case of a call).

Call/Put

A Call is an options contract that gives the buyer the right to buy the underlying commodity at the strike price on the expiration date.

Put is an options contract that gives the buyer the right to sell the underlying commodity at the strike price on the expiration date.

Lot

Number of lots in the transaction.

Note: If your system is configured for trading in amounts instead of lots, then the name of this column will be Amount. (The value of this column is an amount of the first currency in the instrument pair).

B/S

Buy/Sell. Shows in which direction (buy or sell) the position was opened

Open Date/Time

Date and time the position was opened

Open

Trader's rate at which the position was opened.

In a CP record, this field will display the opening price in green italics. (for reference only)

In a PR record, this field will display the opening price in green italics. (for reference only)

Open SWAP

SWAP rate for forward position at opening. The column appears only if at least one forward position was opened within the report period.

Close

Trader's rate at which the position was closed.

In an OP record for a position that is currently open, this field will be empty.

In an OP record for a position that has subsequently been closed, this field will display the closing price in green italics. (for reference only)

In a PR record, this field will display the closing price in green italics. (for reference only)

Close SWAP

SWAP rate for forward position at closing. The column appears only if at least one forward position was closed within the report period.

Value Date

The date when the forward position is closed automatically by the system at the end of the trading day (If position is still open at the end of the trading day), the P/L added to account balance

Option Prem

The amount per unit of currency that an option buyer pays to the seller.

The option premium is primarily affected by the difference between the stock price and the strike price, the time remaining for the option to be exercised, and the volatility of the underlying stock.

D/W/Adj

Deposit/Withdrawal/Adjustment. This column displays any deposits, withdrawals, or adjustments made on the account.

| G$P/L |

Gross profit/loss realized at the time of position closing. The gross profit/loss is the P/L result of the difference between the open/close prices (in system base currency). It does not factor in any commissions, transaction fees, or overnight rollover rates.

Commission

The commission is a service charge on an account for opening a new position applied per lot and measured in system base currency. The commission charge is subtracted from the account balance at the time of the transaction. The overnight commission is an extra commission charge applied at position closing if that position remained open overnight (through the end of the day) at least once. Overnight commission applies per lot and is equal to the regular commission set on the on the account. The number of days that a position remained opened has no bearing on the overnight commission charge. Overnight commission can be used as an alternative to overnight rollover fees.

Note: Some entries in the Commission column may appear in green italics. (This is only true for closing positions transactions.) Entries in green italics are meant for reference only and are not included in totals. These entries show all commissions that were applied to the position or part of the position that was being closed.

Trans fee

Transaction fee. The transaction fee is a charge per lot applied on an account for opening a new position (measured in system base currency). The transaction fee is subtracted from the account balance at the time of the transaction. The column is shown only if transaction fee is enabled on the system or was enabled on the system during the report period (at least one trade was opened during the report period and was charged a transaction fee).

Note: Some entries in the Transaction Fee column may appear in green italics. (This is only true for closing positions transactions.) Entries in green italics are meant for reference only and are not included in totals. These entries show all transaction fees that were applied to the position or part of the position that was being closed.

NFA Fee (if applicable)

The NFA fee is charged per lot at the opening of a new position. It works the same way as a commission or a transaction fee: it is applied per lot and measured in system base currency. The NFA fee is subtracted from the account balance at the time of the transaction. (The NFA Fee option may not be available on your system. Please contact Customer Support for details.)

Note: If there was an NFA fee charged anywhere in the system during the selected report period, then the “NFA Fee” column will appear in the report, even if NFA Fees are not being used at the moment of the report generation. (This is true even if the report is generated for a department in which no NFA fee was ever charged.)

| Overnight Rollover Fee |

Overnight rollover fee (measured in system base currency). Overnight rollover fees are charged to the account and are applied per lot (per contract) to the trade during its lifetime.

If overnight rollover is set in percent for the system, then it will be recalculated and shown in system base currency in this column.

Note: Some entries in the Overnight Rollover Fee column may appear in green italics. (This is only true for closing positions transactions.) Entries in green italics are meant for reference only and are not included in totals. These entries show all overnight rollover fees that were applied to the position or part of the position that was being closed.

| N$P/L |

The net profit/loss of the position, measured in system base currency.

Net P/L = Gross P/L - Commission - Transaction Fee-Trade Charge-NFA Fee +/- Overnight Rollover Fee+/-Future Rollover Adjustment

Trade Charge

Total fixed cost per trade in base currency for this whole transaction. Trade Charge is subtracted from the account balance at the time of the transaction.

Trade charge is an amount in the system base currency set on account for every instrument, paid per trade at position’s Opening or Closing, or at both Opening and Closing.

Note: The column is shown only if trade charge is enabled on the system or was enabled on the system during the report period (trade charge applied at least to one transaction)

Balance

Account balance after the transaction. The balance figure in any transaction record is the resultant balance after the completion of that transaction.

| Equity |

Account equity after the transaction.The equity figure in any transaction record is the resultant equity after the completion of that transaction.

Equity = Balance +/- Floating P/L from Open Positions.

Used Margin

Used margin on the account after the transaction. The used margin figure in any transaction record is the resultant used margin after the completion of that transaction.

User

The initiator of transaction. If the initiator is the trader, then the trader's login ID will be displayed. Other possible values for this field are 'DEALER', 'ADMIN', and 'System'.

Reason

This column displays the cause or reason for the transaction.

CO/CREATE_ORDR |

Order created |

CREATE ORDR. Partial execution of order # |

Partial Close |

HEDGE_TRADE |

Position was hedged |

CT |

Close trade |

AR |

Autoreject |

MC |

Margin Call |

L |

Limit Order |

S |

Stop Order |

ME |

Minimal Equity |

E |

Entry Order |

Markup columns (these columns appear if the Markup check box is selected in the report interface)

OM Pts/$

Position Opening Markup, in pips and system base currency.

The open markup modifies the rate at which the position opens for the trader. The markup setting is a positive number of pips and markups are always charged so as to worsen the trader's rate (i.e. to increase the buy price or decrease the sell price).

The OM Pts/$ column is divided into 2 parts. The left part shows the value of the markup in pips applied at position opening (The markup setting at opening multiplied by the number of lots / contracts in the position; always a positive value).

The right part of the column shows the markup component in the position Net P/L and Gross P/L at opening: markup component in P/L at opening multiplied by the point size and contract size.

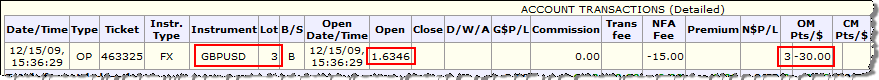

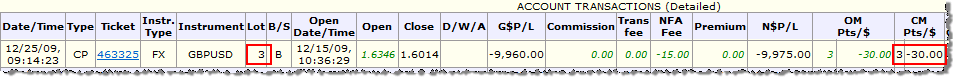

For example, 3 lots Buy position on GBPUSD is opened on trader's account at 1.6346. Open markup on the trader's account is set to 1 pip in ActAdmin. Markup applied at opening is 3 lots * 1 pip = 3 pips - you will see it in the OM Pts. In the position's Net P/L that equals 30 = 3 * 0.0001 (point size) * 100 000 (contract size).

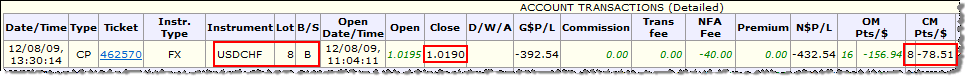

Note: For indirect currency instruments, like USDCAD, USDCHF, the result is further divided by the rate of position opening on account.

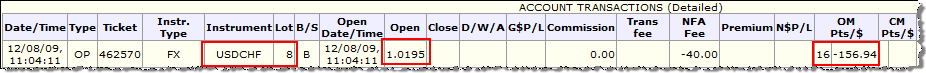

For example, 8 lots Buy position on USDCHF is opened on trader's account at 1.0195. Open markup on the trader's account is set to 2 pips in ActAdmin. Markup applied at opening is 8 lots * 2 pips = 16 pips - you will see it in the OM Pts. In the position's Net P/L that equals 156.94 = 16 * 0.0001(point size) * 100 000(contract size) / 1.0195 (actual open rate on trader's account).

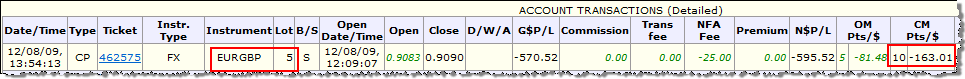

For cross currency instruments, which do not have system base currency in the pair (like EURGBP for system with USD as base currency):

| • | if the second currency in the cross instrument forms a direct pair with the system base currency, then the result is further multiplied by (BID+ASK)/2, where BID and ASK rates are the dealer's rates of the second currency in the cross instrument to the system base currency at position opening (in the example of EURGBP it is GBPUSD). |

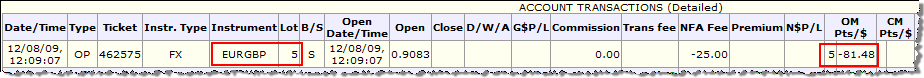

For example, a trader opens 5 lots Sell position on EURGBP while dealer's middle rate for GBPUSD is 1.6296. Open markup on the trader's account is set to 1 pip in ActAdmin. Markup applied at opening is 5 lots * 1 pip = 5 pips - you will see it in the OM Pts. In the position's Net P/L that equals 81.48 = 5 * 0.0001(point size) * 100 000(contract size) * 1.6296 (dealer's middle rate of GBPUSD).

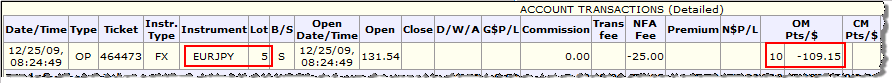

| • | if the second currency in the cross instrument forms an indirect pair with the system base currency, then the result is further divided by (BID+ASK)/2, where BID and ASK rates are the dealer's rates of the system base currency to the second currency in the cross instrument at position opening (in the example of EURJPY it is USDJPY). |

For example: a trader opens 5 lots Sell position on EURJPY while dealer's middle for USDJPY is 91.62. Open markup on the trader's account is set to 2 pips in ActAdmin. Markup applied at opening is 5 lots * 2 pip = 10 pips - you will see it in the OM Pts. In the position's Net P/L that equals: -109.15=10 * 0.01(point size) * 100 000 (contract size) / 91.62 (dealer's middle rate of USDJPY).

CM Pts/$

Position Closing Markup, in pips and system base currency.

The close markup modifies the rate at which the position closes for the trader. The markup setting is a positive number of pips and markups are always charged so as to worsen the trader's rate (i.e. to increase the buy price or decrease the sell price).

The CM Pts/$ column is divided into 2 parts. The left part shows the total value of the markup in pips applied at position closing (The markup setting multiplied by the number of lots / contracts in the position; always a positive value).

The right part of the column shows: the markup component in the position Net P/L and Gross P/L at closing: close markup component in the position P/L multiplied by the point size and contract size.

For example, 3 lots Buy position on GBPUSD is closed on trader's account at 1.6014. Close markup on the trader's account is set to 1 pip in ActAdmin. Markup applied at closing is 3 lots * 1 pip = 3 pips - you will see it in the CM Pts. In the position's Net P/L that equals 30 = 3 * 0.0001 (point size) * 100 000 (contract size).

Note: For indirect currency instruments, like USDCAD, USDCHF, the result is further divided by the rate of position closing on account.

For example, 8 lots Buy position on USDCHF is closed on trader's account at 1.0190. Close markup on the trader's account is set to 1 pip in ActAdmin. Markup applied at position's closing is 8 lots * 1 pip = 8 pips - you will see it in the CM Pts. In the position's Net P/L that equals 78.51 = 8 * 0.0001 (point size) * 100 000 (contract size) / 1.0190 (actual close rate on trader's account).

For cross currency instruments, which do not have system base currency in the pair (like EURGBP for system with USD as base currency):

| • | if the second currency in the cross instrument forms a direct pair with the system base currency, then the result is further multiplied by (BID+ASK)/2, where BID and ASK rates are the dealer's rates of the second currency in the cross instrument to the system base currency at position closing (in the example of EURGBP it is GBPUSD). |

For example, a trader closes 5 lots Sell position on EURGBP while dealer's middle rate for GBPUSD is 1.6301. Close markup on the trader's account is set to 2 pips in ActAdmin. Markup applied at position's closing is 5 lots * 2 pips = 10 pips - you will see it in the CM Pts. In the position's Net P/L that equals 163.01 = 10 * 0.0001(point size) * 100 000(contract size) * 1.6301 (dealer's middle rate of GBPUSD)

| • | if the second currency in the cross instrument forms an indirect pair with the system base currency, then the result is further divided by (BID+ASK)/2, where BID and ASK are the dealer's rates of the system base currency to the second currency in the cross instrument at position closing (in the example of EURJPY it is USDJPY). |

For example, a trader closes 5 lots Sell position on EURJPY while middle rate for USDJPY is 91.62. Close markup on the trader's account is set to 2 pips in ActAdmin. Markup applied at position's closing is 5 lots * 2 pips = 10 pips - you will see it in the CM Pts. In the position's Net P/L that equals 109.15 = 10 * 0.01(point size) * 100 000(contract size) / 91.62 (dealer's middle rate of USDJPY)

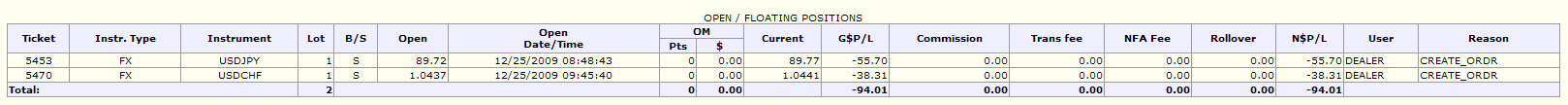

Open/Floating Positions

This section lists all open/floating positions as of the end of the report period.

Column descriptions (Unless otherwise noted, the columns in this section correspond directly to the columns in the Account Transactions section)

Current

The current trader's rate (as of the end of the report period). Excludes closing markup.

| G$P/L |

The unrealized gross profit/loss at the end of the report period. The gross profit/loss is simply the result of the difference between the buy/sell prices (in system base currency). It does not factor in any commissions, transaction fees, or overnight rollover rates.

| N$P/L |

The unrealized net profit/loss of the position, measured in system base currency.

Net P/L = Gross P/L - Commission - Transaction Fee-Trade Charge-NFA Fee +/- Overnight Rollover Fee+/-Future Rollover Adjustment

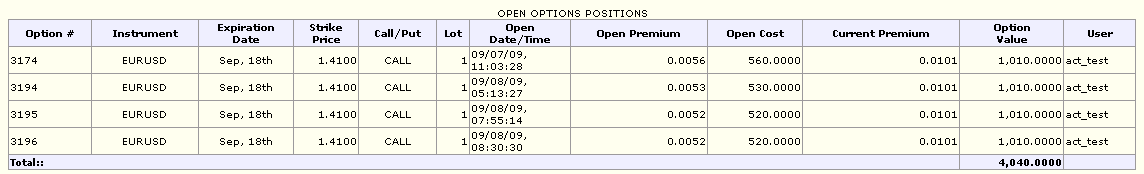

Open Options Positions

This section lists all open options positions as of the end of the report period.

Columns descriptions

Option#

The option number

Instrument

Instrument name. This is the name that can be set and customized by the administrator in the Instruments section of the ActAdmin. For example, for GBPUSD, the instrument name may read "Cable".

Expiration Date

Option expiration date.

Strike Price

The specified price on an option contract at which a call option buyer can buy the underlie or a put option buyer can sell the underlie.

The buyer's profit from exercising the option is the amount by which the strike price exceeds the spot price (in the case of a put), or the amount by which the spot price exceeds the strike price (in the case of a call).

Call/Put

A Call is an options contract that gives the buyer the right to buy the underlying commodity at the strike price on the expiration date.

Put is an options contract that gives the buyer the right to sell the underlying commodity at the strike price on the expiration date.

Lot

Number of lots in the option. If the system is set in amounts, the column is titled Amount and displays the amount in the option.

Open Date/Time

The date and time of opening of the option.

Open Premium

Premium at opening of the option. Premium is calculated by the system using the volatility data specified in ActAdmin or Static Volatility. Premium is used to calculate open cost of the option.

Open Cost

Total cost of opening of the option position. The open cost is subtracted from the account balance at the time of the transaction.

Open cost is calculated by the system via the following formula:

Cost = Premium*Contract size*Number of lots

Note: If the resulting open cost is less than the Minimum Cost, then the Minimum Cost will be applied instead of the above formula. The Minimum Cost is equal to the Number of Lots*Minimum Cost per Lot specified in ActAdmin for this instrument. In this case, the Premium is not used to calculate the open cost of the option.

Current Premium

Premium at the end of report period. Premium is calculated by the system using the volatility data specified in ActAdmin or Static Volatility. Current Premium is used to calculate the option value.

Option Value

The value the trader would receive for closing of the option position at the end of report period. Option value would be added to the account balance at the time of the transaction.

Option value is calculated by the following formula:

Option Value = Current Premium*Contract size*Number of lots.

Note: The Minimum Cost per lot setting has no effect on determining the option value.

User

The login of the trader or dealer that confirmed the buy option transaction.

Report Summary/Footer Information

This section shows summarized info for the report period.

Description

Beginning balance

Balance at the beginning of the report period

| Total Gross $P/L from settled trades |

Total gross profit or loss on all positions closed within the report period

Commission

Sum of all commissions charged within the report period.

Transaction fee

Sum of all transaction fees charged within the report period

| Overnight Rollover Fee |

Sum of all overnight rollover fees applied to all open positions within the report period

Deposit

Total sum of account deposits within the report period

Withdrawal

Total sum of account withdrawals within the report period

Adjustment

Total sum of account adjustments within the report period

Net D/W/A

Sum of deposits, withdrawals, and adjustments within the report period

Net D/W/A = Deposits - Withdrawals +/- Adjustments

Ending balance

Balance at the end of the report period.

| Total gross $P/L from open positions |

Total floating gross profit or loss on all open positions at the end of the report period.

Equity

Equity at the end of the report period.

Used margin

Used margin at the end of the report period.

Usable margin

Usable margin at the end of the report period.

Footer

The footer is optional text appearing at the bottom of the report. It is configured by the system administrator. The footer appears at the bottom of each page of the report. If the No Pagination option is selected, the footer appears only once, at the bottom of the report. In the Account Statement report by email, the footer appears only once, at the end of the email.

ACCOUNT STATEMENT BY EMAIL:

An Account Statement can be sent to traders and/or customers via email. Customers and traders will receive reports daily (on trading days) provided that there were any transactions during that day or that their accounts had any remaining open positions at the end of the day. Additionally on the last trading day of the month they will also receive a monthly trading report provided that there were any transactions during that month or that their accounts had any remaining open positions at the end of the month. Reports are sent at the end of the trading day. Contact your system administrator for more information on this option.

Exporting the Report

The Account Statement report can be exported into Microsoft Excel from ActTrader only. Right-click on the report body, and select Export to Microsoft Excel.